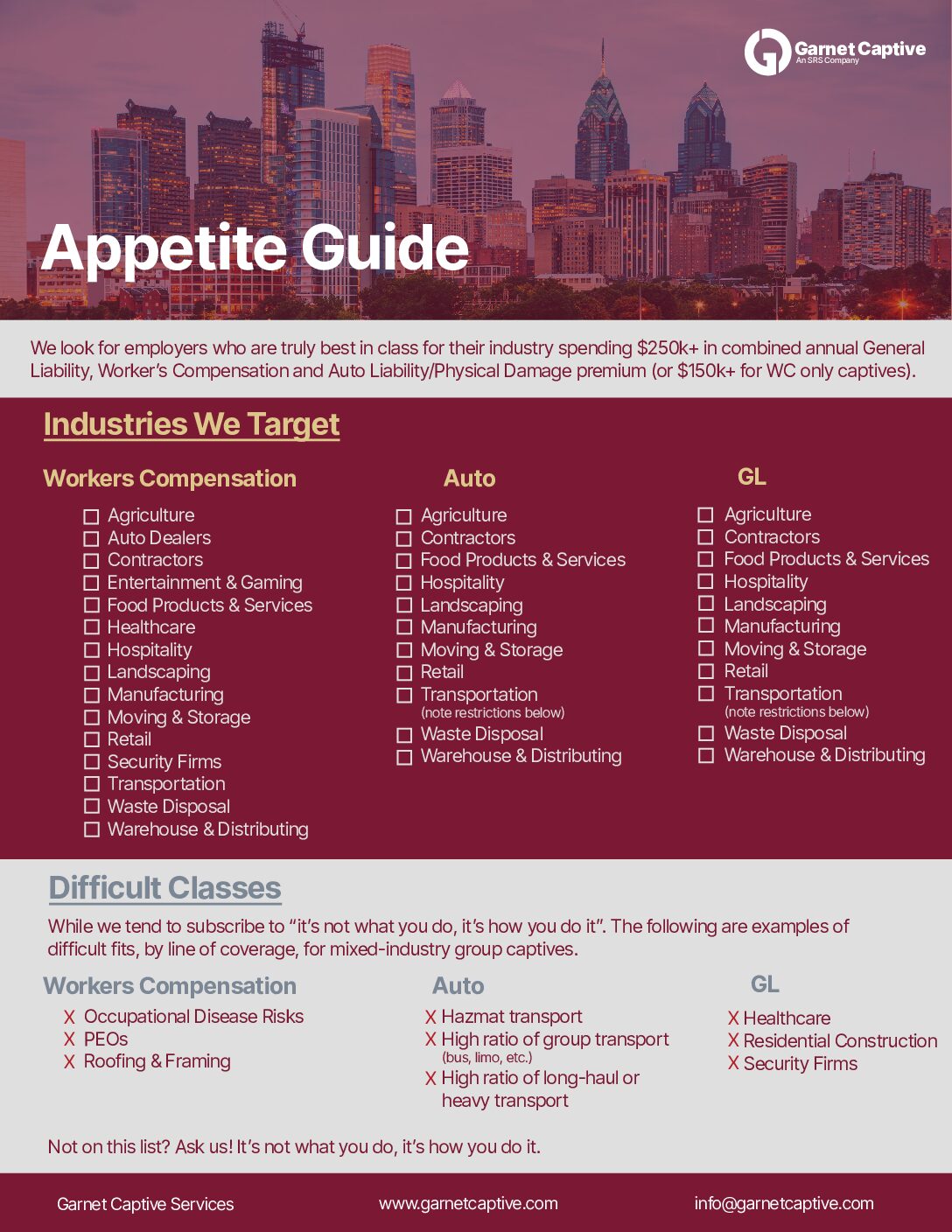

Heterogenous Captives

A captive in which businesses from multiple different industries can achieve greater spread of risk.

What is a Group Captive?

A group captive is an insurance program owned and controlled solely by its members.

By joining with other industries, you can diversify your risk exposure, reducing the impact of industry-specific challenges.

This collaboration leads to overall cost savings, control over your business’s insurance program, and improve your risk management.

How You’ll Benefit

Stability and Predictability

Garnet group captive members jointly absorb and manage the risks, mitigating the impact of market fluctuations and rate increases often found in traditional insurance.

High Quality Service Partners

Garnet Captive group members are supported by high quality, better than average claims adjusting partners, who specialize in customer service and seek the lower possible final cost of claims.

Education

Members have access to a robust online web platform, customized to give businesses the tools needed to enhance your overall risk control program.

Is a Group Captive Right for You?

Our Captives

CommonWealth

For US based businesses except California

Our Commonwealth group captive program is the workers compensation solution for middle sized businesses. If your business has a strong track record of safety and are tired of subsidizing the general insurance market, the Commonwealth group captive is right for you. (Targeted for employers paying a minimum traditional annual premium of $125,000)

Garnet Liability Captive

For US based businesses except California

Garnet Liability Captive (GLC) is a captive solution for employers that currently participate, or plan to participate, in one of Garnetʼs existing workers compensation captives. GLC offers coverage for auto liability, auto physical damage, and general liability. (Targeted for employers paying a minimum traditional annual premium of $125,000)

RST

For California based businesses only

RST is a heterogenous group captive program for businesses with headquarters in California. Established in 2003, RST is an alternative workers compensation solution for middle sized employers seeking stability of their premiums levels that otherwise fluctuate with the standard market. (Targeted for employers paying a minimum traditional annual premium of $100,000)

Union

For California based businesses only

Established in 2004, Union is a multi-industry, workers compensation group captive program, designed for businesses based in California. Created for middle sized employers with an above-average loss history who want to bet on themselves by taking on a higher primary fund retention with stabilized premiums. (Targeted for employers paying a minimum traditional annual premium of $150,000)

Contact Us

ADDRESS

Garnet Captive Services

FMC Tower at Cira Centre South

2929 Walnut Street , Suite 1500

Philadelphia, PA 19104

For information: info@garnetcaptive.com

Member submission: submissions@garnetcaptive.com

Loss control: losscontrol@garnetcaptive.com