Group Captives

Over 80% of Members in Garnet-run group captives have received distributions totaling tens of millions of dollars. This is underwriting profit that would have otherwise been pocketed by the conventional insurance industry.

What is a Group Captive?

A group captive is an insurance program owned and controlled solely by its members.

By joining with other industries, you can diversify your risk exposure, reducing the impact of industry-specific challenges.

This collaboration leads to overall cost savings, control over your business’s insurance program, and improve your risk management.

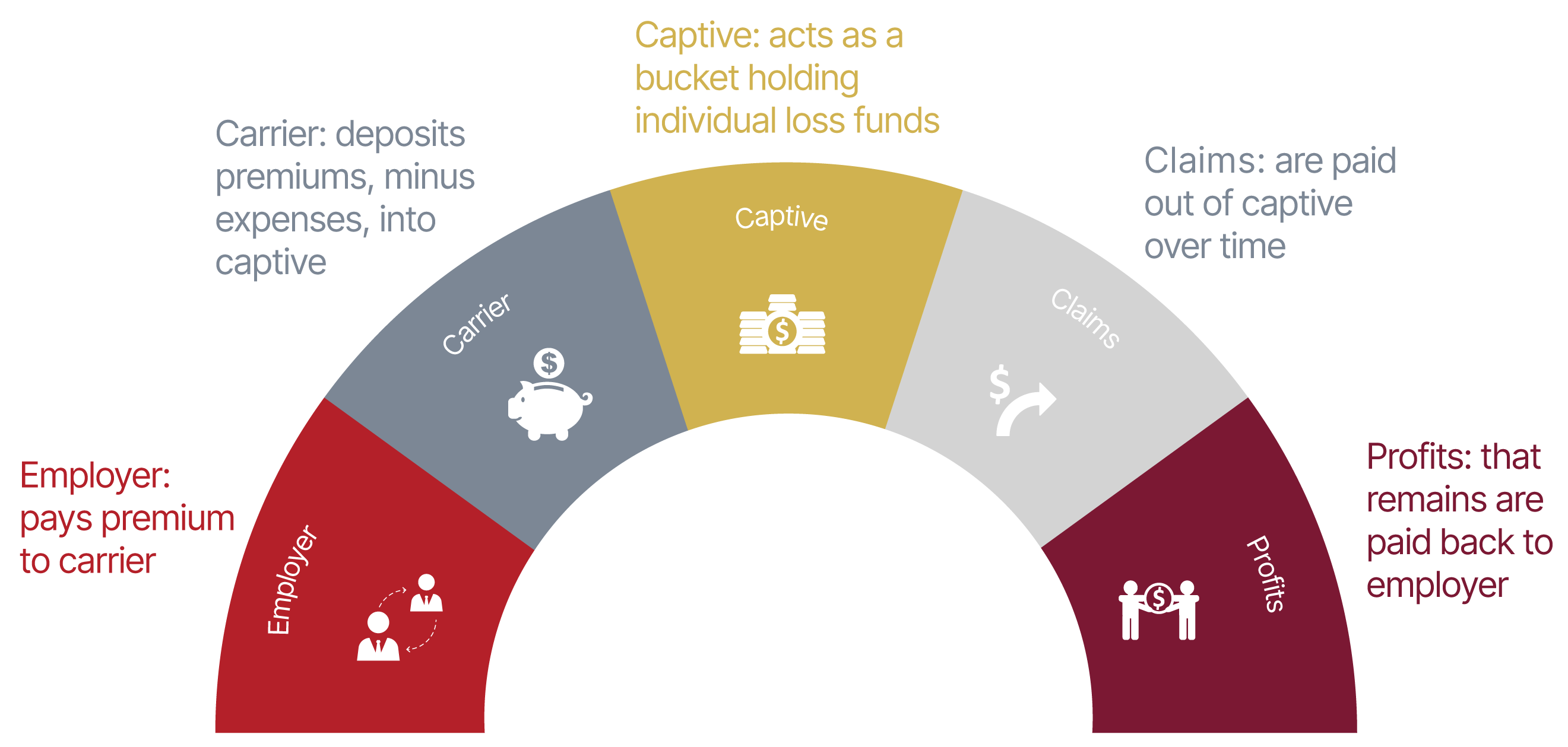

How Captives Work

A group captive is an alternative to traditional insurance. Captives provide best-in-class businesses with more control over their insurance costs through long-term pricing stability, fixed cost reductions, and the chance to recoup underwriting profits via distributions. Garnet’s group captives allow business owners to avoid volatile market swings and pay their actual insurance cost, rather than the market rate for their industry.

Program Structure

Garnet’s group captive programs involve a policy-issuing carrier, which issues a policy and collects a premium (1). The predictable portion of the premium is then transferred, or ceded, to the captive (2). As predictable losses are paid (4), the captive reimburses the carrier for the losses. Members earn investment income on the funds held at the captive (3). Once the policy period has expired, the captive returns unused funds to the captive Members over time (5).

Garnet’s group captive programs have a proven track record of returning underwriting profit back to captive Members every year.

Open Programs

Garnet Captive provides alternative workers compensation, general liability, auto liability, and auto physical damage insurance solutions for mid-sized businesses through our unique group captive programs:

For more information about our programs please contact info@garnetcaptive.com

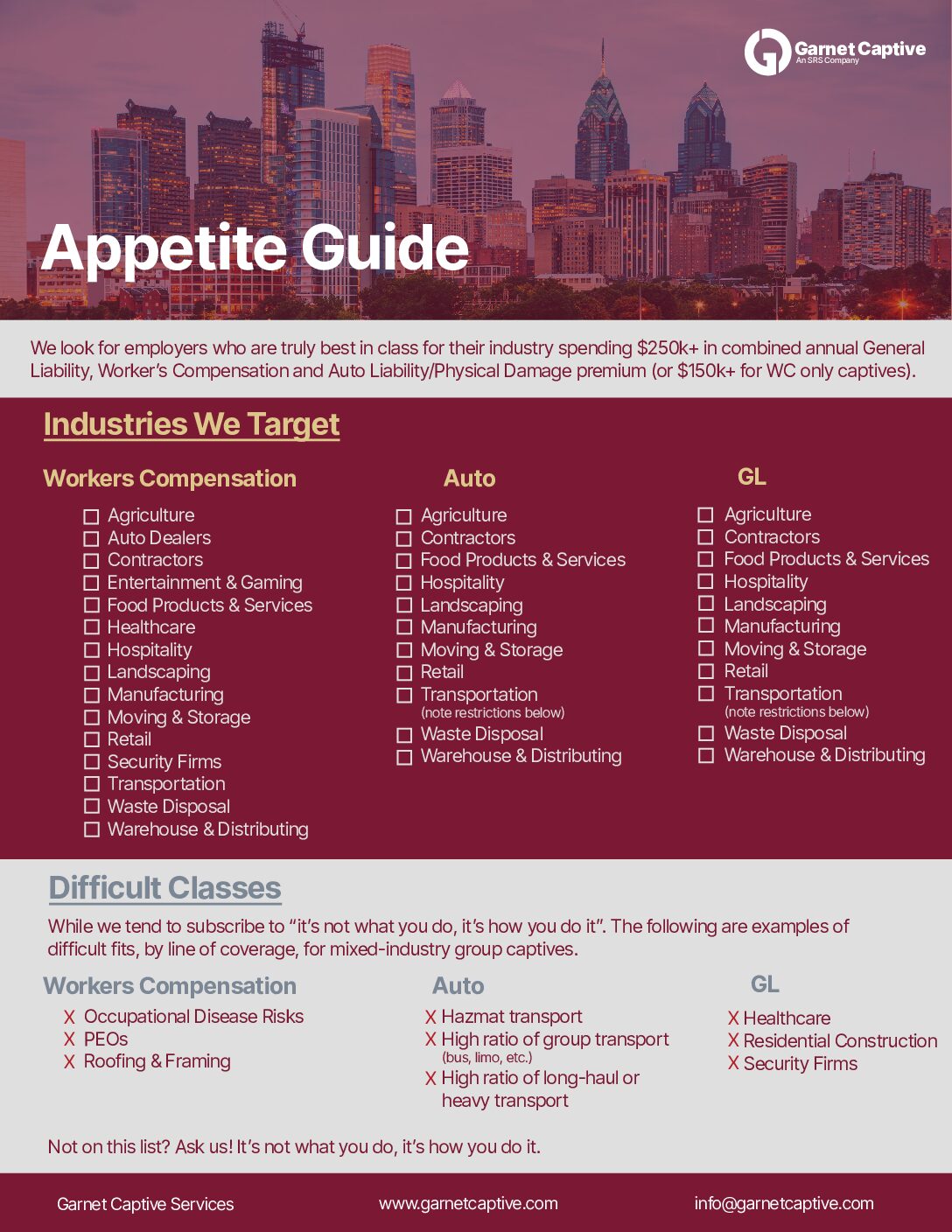

SUBMISSION REQUIREMENTS

The success of a group captive is predicated on the superior risk profile of its Member companies. Garnet takes great effort to only invite best-in-class businesses into its groups. As such, the availability and quality of submission data is critical. The more accurate and detailed the submission, the more successful the captive admittance process. At a minimum: any submission should include:

- Description of products and operations

- Completed submission template

- Acord application

- Supplemental application

- Five years of currently valued loss runs

- Financial statements

- Current and expiring experience modification worksheets

Submissions may be emailed to submissions@garnetcaptive.com

How You’ll Benefit

Stability and Predictability

Garnet group captive members jointly absorb and manage the risks, mitigating the impact of market fluctuations and rate increases often found in traditional insurance.

High Quality Service Partners

Garnet Captive group members are supported by high quality, better than average claims adjusting partners, who specialize in customer service and seek the lower possible final cost of claims.

Education

Members have access to a robust online web platform, customized to give businesses the tools needed to enhance your overall risk control program.

Is a Group Captive Right for You?

Contact Us

ADDRESS

Garnet Captive Services

FMC Tower at Cira Centre South

2929 Walnut Street , Suite 1500

Philadelphia, PA 19104

For information: info@garnetcaptive.com

Member submission: submissions@garnetcaptive.com

Loss control: losscontrol@garnetcaptive.com